When it comes to building a new warehouse or distribution center for your order fulfillment or materials handling operation, there are a number of factors that must be considered. Location (where in the country you should build your new facility) is one of the factors that get the most attention.

But settling on location before settling on how big your new facility needs to be is a little like putting the cart before the horse: It doesn’t make a whole lot of sense.

Because the size of your warehouse or DC will inform countless parts of your design build strategy (including the types of technology you ultimately use, how much inventory you can realistically have on hand, the cost of land, etc.) it should realistically be one of the first things that you settle once you have decided to move ahead with a design build.

It is essential to make sure that you’re building the new facility to the appropriate size: Building too large can be a waste of capital that could potentially be put to better use; too small, and you risk quickly outgrowing the facility, prompting a costly redesign or expansion just a few years down the road.

Below, we offer some guidelines for how operations can appropriately choose a size for their next warehouse or DC.

How big is your current facility?

When you are determining the size of your new facility, it makes sense to use the size of your current facility as a starting point for the discussion. How much space do you currently have? Are you putting that space to use efficiently, or do you think there are optimizations that could be put in place to make better use of the space? Do you believe that your current facility has too much space, too little space, or just enough?

By understanding the successes or limitations of your current facility, you can extrapolate (roughly) whether your new facility should be of similar or different size. If you are constantly running out of space in your current facility, and your new facility will encounter similar throughputs and demand, then it makes sense to go larger; if you have a lot of wasted or empty space, it is possible that your new facility can be smaller and still be just as productive, saving you money in the form of taxes, property costs, utilities, etc.

It is important to keep in mind that this quick-and-dirty approach is not enough to settle on a final size—it should simply be used to ballpark the answer at the beginning of your discussions and planning.

How does product flow through your operation, and what processes are required for that?

In every operation, goods and product flow through a unique set of processes from the moment they arrive in the warehouse to when they are shipped as a part of an order to a customer. No operation handles its products in exactly the same way. But these processes will determine how a large portion of your new facility’s footprint is put to use (because it will determine which technologies such as conveyors and sorters are put in place) and for that reason, it is critical to understand flow before you settle on a layout or building size.

By firmly understanding your current flow of product, when designing your new facility it is possible that you can find more efficient ways of doing things that can reduce your total order cycle time and even the space that is required for your facility.

How much inventory so you typically have on hand at any given time? Is this inventory being stored efficiently?

This point is critical for obvious reasons. The amount of inventory that your operation must have on hand to stay in business will dictate how a large portion of your new facility’s space will be used.

Once you understand your current inventory needs, determine whether or not there are ways that you can make better use of the space that you have dedicated to inventory compared to what you are currently doing.

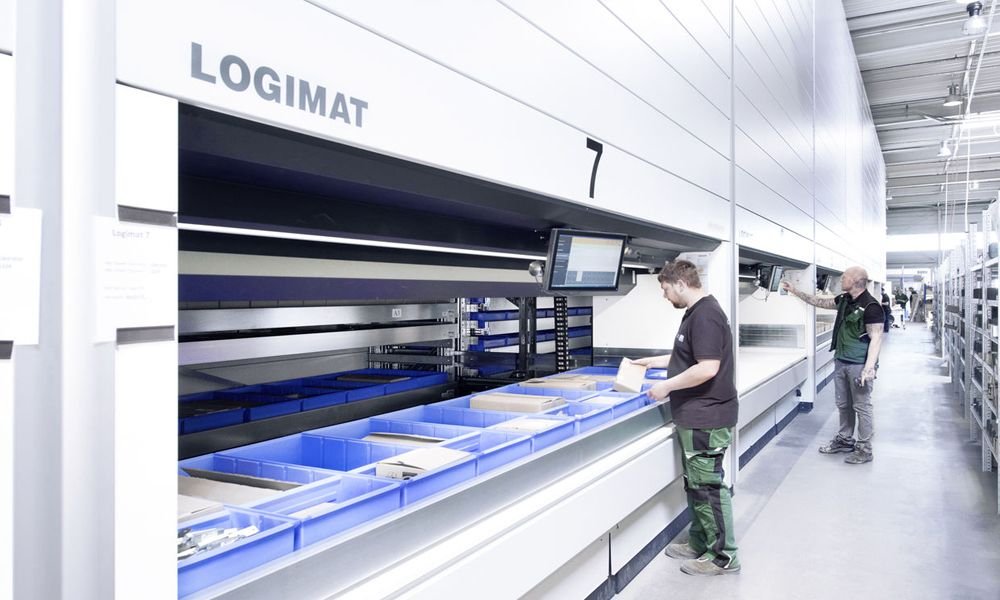

Automated Storage and Retrieval Systems (AS/RS) paired with a rack-supported structure, for example, may offer substantial space savings. Another example might be implementing a system of drop-shipping larger items so that you do not need to keep them in long-term inventory, reducing the amount of inventory space necessary to keep your operation moving.

How much do you plan to grow?

Chances are good that you are opening a new warehouse or DC to accommodate an increase in demand: Your business is growing, and you need another facility to deliver what your customers want.

It is important to keep business growth in mind when building your new facility, because if you aren’t careful, you may find yourself quickly outgrowing the new space, leading you to a costly redesign, expansion, or to build another new facility.

If there are strong indications that growth will be rapid, it may be in your best interest to preemptively build out the capacity of your facility. If growth will be slower, it may make more sense to do so incrementally as the increased demand arises.

The Bottom Line

When building a new DC or warehouse, settling on the size of your new facility is one of the most crucial steps in the process, as it will inform much of what comes later (the systems and technologies you put in place; the plot of land that you purchase and build on, how large of a workforce you can hire, etc.).

The questions above can be used to help you determine what an appropriate size will be for your current needs and future growth but is not by any means a complete list of factors. The size of your new facility will ultimately be determined by these large notions as well as specifics, such as pallet size, aisle width, load-bearing capacity, and more.